Global Credit Line

Name

Global Credit Line

Introduction

Global credit line is an extension of the application scope of traditional credit line products, and its major function is to fulfill the financing needs of group companies' overseas affiliates.To be specific, answering to enterprises' strategy of cross-border development, global credit line takes advantages of Bank of China's far-ranging overseas branch networks to provide group companies' overseas affiliates an overall financing package.

Features

- It provides customers with prompt, comprehensive and standard bank services by easy and efficient cooperation mode.

- It can save the cooperation costs of the customer and the bank.By cooperation between enterprises and the bank, the operational procedures are simplified and financing efficiency is improved.

- It can strengthen the customer's self-financing and centralized management.With the bank's help, the corporate headquarter can realize the centralized control over its overseas affiliates' financing and enhance the management of overseas operational risks.

Target Customers

Global credit line is a product tailored for large enterprise group customers dedicated to overseas development.Because of their high prestige, strong operating capacity, sound funds and technology strength, these customers are the bank's key target customers.

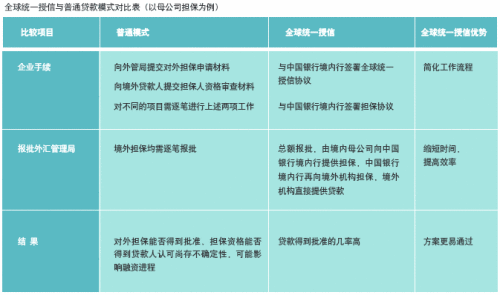

The table below compares two operating modes, namely, the loan application of overseas affiliates with the domestic parent firm's guarantee and that of the bank's global credit line:

Application Qualification

- The group customer should be a enterprise legal person registered in China.

- The establishment of overseas affiliates has been approved by China's competent authorities.

- Foreign exchange registration for overseas investment has been completed in China's administration authority of foreign exchange.

- Overseas invested enterprise has been legally registered overseas.

- The overseas credit line supports the business which is in compliance with China's "going out" strategy, the credit line policy of Bank of China and the main operation of the enterprises.

- The group customer should be a key customer at head office level of Bank of China and should rank above Grade A (inclusive) at Bank of China's credit rating system.

- The applicant should provide counter-guarantee approved by Bank of China.

- The applicant should meet other credit requirements of Bank of China.

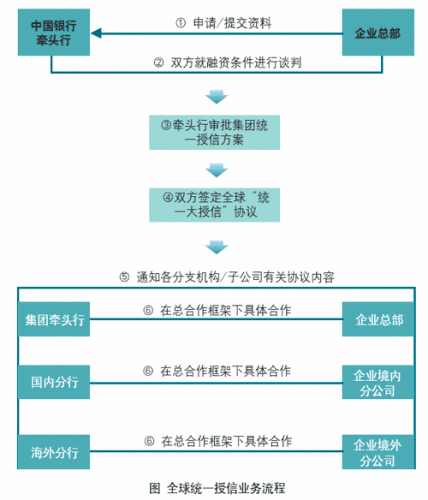

Procedure